All Categories

Featured

Table of Contents

Degree term life insurance policy is a plan that lasts a set term usually between 10 and thirty years and comes with a level fatality advantage and level costs that remain the exact same for the entire time the plan is in impact. This indicates you'll know specifically just how much your repayments are and when you'll need to make them, permitting you to budget as necessary.

Degree term can be a terrific choice if you're looking to get life insurance coverage for the very first time. According to LIMRA's 2023 Insurance Measure Study, 30% of all grownups in the U.S. demand life insurance policy and don't have any kind of plan yet. Level term life is foreseeable and economical, that makes it one of one of the most popular types of life insurance policy.

A 30-year-old male with a similar profile can anticipate to pay $29 each month for the exact same protection. AgeGender$250,000 coverage quantity$500,000 insurance coverage quantity$1 million protection amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Methodology: Typical monthly prices are determined for male and women non-smokers in a Preferred health and wellness classification acquiring a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy.

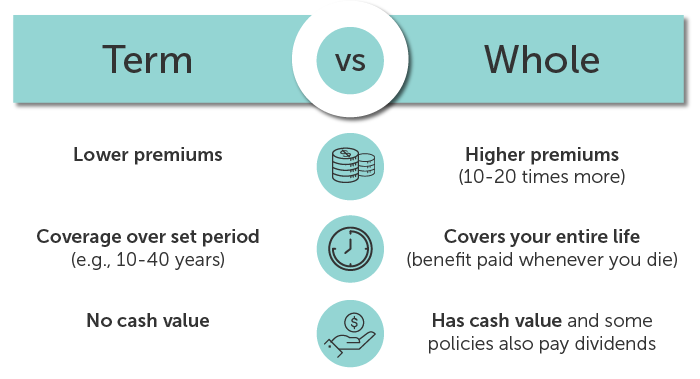

Rates may vary by insurance provider, term, protection amount, health and wellness class, and state. Not all plans are readily available in all states. Rate illustration valid as of 09/01/2024. It's the most affordable form of life insurance policy for the majority of individuals. Degree term life is far more economical than a similar whole life insurance policy policy. It's simple to take care of.

It allows you to spending plan and plan for the future. You can easily factor your life insurance right into your budget plan due to the fact that the premiums never ever transform. You can prepare for the future simply as easily due to the fact that you understand precisely how much money your enjoyed ones will get in case of your lack.

What is 20-year Level Term Life Insurance Coverage Like?

In these situations, you'll usually have to go with a brand-new application procedure to obtain a better rate. If you still require protection by the time your level term life policy nears the expiry date, you have a few choices.

Many degree term life insurance plans come with the option to renew insurance coverage on an annual basis after the initial term ends. The cost of your plan will be based on your present age and it'll boost each year. This can be an excellent option if you just need to expand your coverage for a couple of years otherwise, it can obtain expensive quite quickly.

Degree term life insurance is one of the most inexpensive coverage choices on the marketplace because it supplies standard defense in the type of death benefit and only lasts for a set time period. At the end of the term, it ends. Entire life insurance policy, on the various other hand, is considerably much more pricey than degree term life since it doesn't end and comes with a cash value function.

Not all policies are available in all states. Level term is a fantastic life insurance coverage choice for most individuals, however depending on your protection needs and individual circumstance, it could not be the ideal fit for you.

Annual eco-friendly term life insurance policy has a term of only one year and can be renewed yearly. Annual sustainable term life premiums are at first less than level term life costs, yet costs rise each time you restore. This can be an excellent alternative if you, for example, have simply give up smoking cigarettes and need to wait two or three years to get a degree term policy and be eligible for a lower price.

, your fatality benefit payment will certainly lower over time, but your settlements will certainly stay the very same. On the various other hand, you'll pay even more in advance for much less protection with a raising term life policy than with a degree term life policy. If you're not sure which type of plan is best for you, working with an independent broker can help.

As soon as you have actually decided that level term is right for you, the following step is to purchase your plan. Below's how to do it. Determine just how much life insurance coverage you need Your protection quantity should offer your household's long-term economic requirements, including the loss of your revenue in the occasion of your fatality, as well as debts and day-to-day expenses.

The most popular kind is currently 20-year term. A lot of companies will not market term insurance to a candidate for a term that ends past his/her 80th birthday. If a policy is "renewable," that suggests it continues effective for an added term or terms, up to a defined age, even if the health and wellness of the guaranteed (or other variables) would cause him or her to be rejected if he or she got a brand-new life insurance plan.

So, premiums for 5-year renewable term can be level for 5 years, then to a new rate mirroring the brand-new age of the guaranteed, and so forth every 5 years. Some longer term plans will certainly assure that the premium will certainly not raise throughout the term; others do not make that guarantee, allowing the insurance coverage business to elevate the price during the policy's term.

What is the Advantage of Term Life Insurance With Accidental Death Benefit?

This implies that the plan's proprietor can change it into an irreversible kind of life insurance coverage without added proof of insurability. In many kinds of term insurance coverage, including homeowners and automobile insurance coverage, if you have not had an insurance claim under the policy by the time it ends, you obtain no refund of the costs.

Some term life insurance policy customers have been dissatisfied at this result, so some insurance companies have actually developed term life with a "return of costs" feature. The costs for the insurance coverage with this function are frequently dramatically more than for plans without it, and they normally call for that you maintain the plan active to its term or else you surrender the return of premium benefit.

Level term life insurance policy premiums and fatality advantages remain consistent throughout the policy term. Level term plans can last for periods such as 10, 15, 20 or thirty years. Degree term life insurance policy is generally more cost effective as it doesn't build cash money worth. Degree term life insurance coverage is among the most common sorts of protection.

While the names commonly are used mutually, degree term protection has some crucial differences: the premium and fatality benefit stay the same throughout of protection. Level term is a life insurance policy policy where the life insurance policy costs and survivor benefit stay the same for the period of protection.

Table of Contents

Latest Posts

Covering Funeral Costs

What Is Funeral Insurance

Immediate Cover Funeral Plan

More

Latest Posts

Covering Funeral Costs

What Is Funeral Insurance

Immediate Cover Funeral Plan