All Categories

Featured

Table of Contents

That usually makes them a much more budget friendly alternative forever insurance policy protection. Some term policies may not maintain the costs and survivor benefit the exact same over time. You don't want to wrongly believe you're buying degree term coverage and after that have your death advantage change in the future. Lots of people get life insurance policy coverage to help financially safeguard their enjoyed ones in instance of their unexpected fatality.

Or you might have the option to convert your existing term coverage right into a long-term plan that lasts the rest of your life. Various life insurance coverage policies have prospective benefits and downsides, so it's vital to understand each before you make a decision to acquire a plan.

As long as you pay the premium, your recipients will certainly receive the death benefit if you pass away while covered. That stated, it is essential to keep in mind that the majority of plans are contestable for 2 years which suggests coverage could be retracted on death, ought to a misstatement be found in the app. Plans that are not contestable frequently have a rated survivor benefit.

Costs are usually reduced than whole life policies. With a degree term plan, you can choose your insurance coverage quantity and the plan size. You're not secured right into an agreement for the rest of your life. Throughout your policy, you never ever need to stress over the costs or survivor benefit amounts altering.

And you can not cash out your policy throughout its term, so you will not receive any kind of financial gain from your past insurance coverage. Similar to other types of life insurance policy, the cost of a degree term plan depends on your age, protection needs, work, lifestyle and health. Usually, you'll discover extra budget friendly coverage if you're more youthful, healthier and much less risky to insure.

Dependable Term Life Insurance For Couples

Because level term premiums remain the exact same for the duration of protection, you'll know specifically just how much you'll pay each time. Level term protection likewise has some versatility, enabling you to customize your plan with extra attributes.

You might have to fulfill particular problems and certifications for your insurer to enact this cyclist. There also can be an age or time restriction on the protection.

The fatality benefit is normally smaller, and coverage typically lasts until your youngster turns 18 or 25. This biker may be a much more cost-effective method to help guarantee your children are covered as riders can typically cover multiple dependents simultaneously. As soon as your child ages out of this insurance coverage, it may be feasible to convert the biker into a brand-new policy.

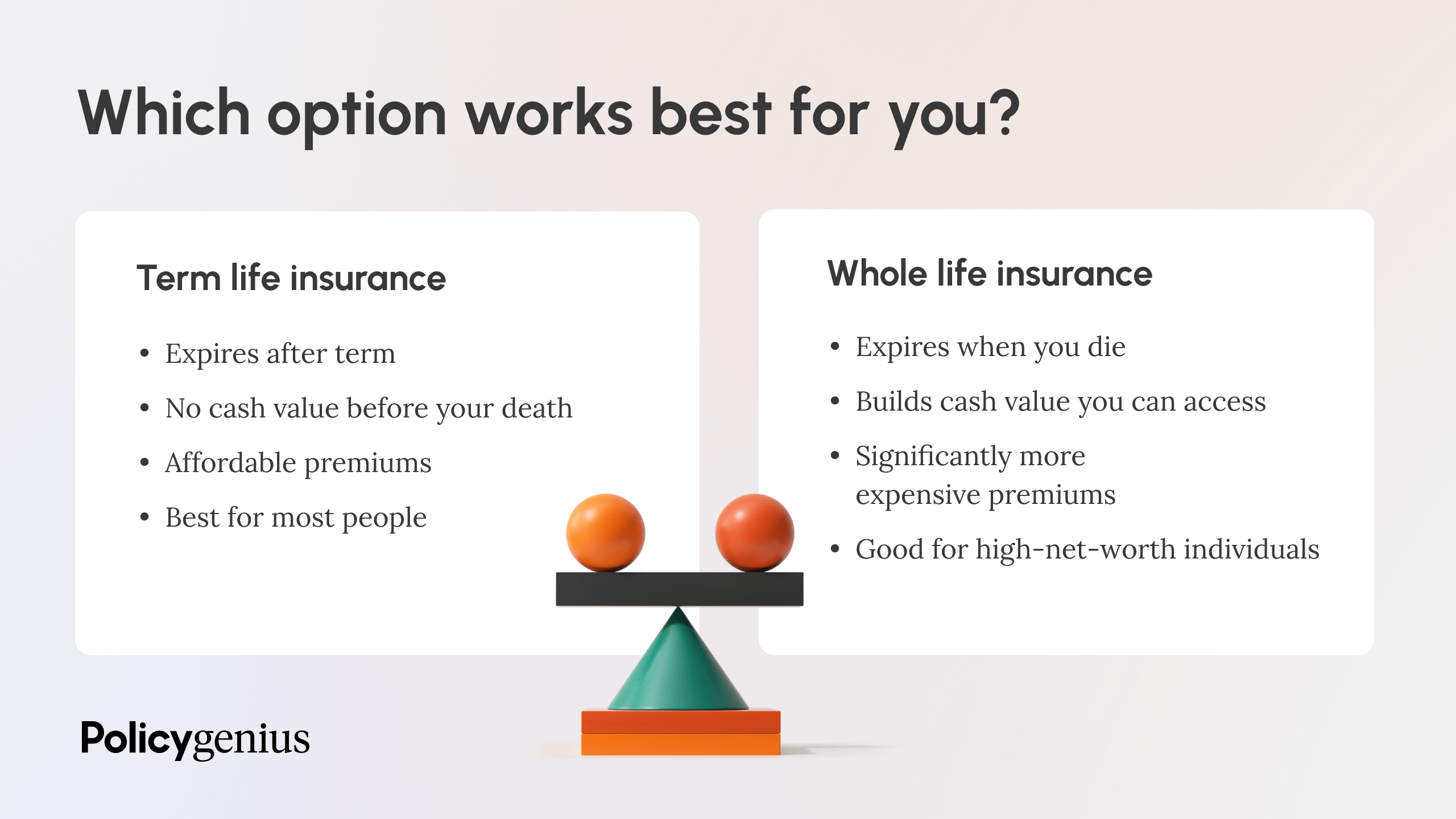

When comparing term versus irreversible life insurance policy. term life insurance with accidental death benefit, it is necessary to bear in mind there are a couple of different types. One of the most typical sort of irreversible life insurance policy is whole life insurance policy, but it has some essential distinctions contrasted to degree term protection. Right here's a fundamental introduction of what to take into consideration when contrasting term vs.

Entire life insurance coverage lasts for life, while term insurance coverage lasts for a particular duration. The costs for term life insurance policy are normally lower than entire life protection. Nevertheless, with both, the costs remain the exact same throughout of the plan. Entire life insurance coverage has a money value component, where a portion of the premium may grow tax-deferred for future demands.

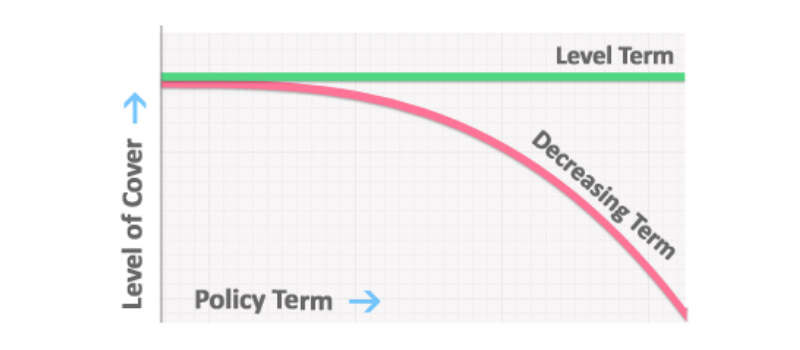

Among the highlights of degree term coverage is that your costs and your survivor benefit don't change. With decreasing term life insurance policy, your premiums stay the very same; nonetheless, the fatality advantage amount obtains smaller gradually. As an example, you might have insurance coverage that begins with a survivor benefit of $10,000, which might cover a home loan, and after that annually, the survivor benefit will decrease by a collection quantity or portion.

Due to this, it's frequently a more economical kind of level term coverage., yet it may not be adequate life insurance policy for your demands.

After picking a plan, finish the application. For the underwriting process, you may have to give general individual, wellness, lifestyle and employment details. Your insurance firm will certainly identify if you are insurable and the risk you may provide to them, which is reflected in your premium costs. If you're approved, authorize the documentation and pay your initial costs.

Renowned Voluntary Term Life Insurance

You may desire to upgrade your recipient information if you've had any kind of substantial life adjustments, such as a marital relationship, birth or divorce. Life insurance policy can in some cases really feel difficult.

No, degree term life insurance policy doesn't have money value. Some life insurance policy policies have a financial investment attribute that allows you to construct money worth gradually. A part of your premium settlements is reserved and can make rate of interest with time, which expands tax-deferred during the life of your protection.

Nevertheless, these plans are usually substantially extra expensive than term coverage. If you reach completion of your plan and are still alive, the protection ends. However, you have some alternatives if you still desire some life insurance coverage. You can: If you're 65 and your insurance coverage has actually gone out, for example, you might intend to buy a brand-new 10-year degree term life insurance policy policy.

Direct Term Life Insurance Meaning

You may have the ability to convert your term protection right into a whole life plan that will certainly last for the remainder of your life. Several kinds of level term policies are exchangeable. That indicates, at the end of your coverage, you can convert some or every one of your policy to whole life coverage.

Degree term life insurance coverage is a policy that lasts a set term usually in between 10 and thirty years and includes a degree survivor benefit and degree costs that stay the exact same for the entire time the plan is in impact. This suggests you'll know exactly how much your payments are and when you'll need to make them, enabling you to budget plan accordingly.

Degree term can be an excellent choice if you're aiming to purchase life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance coverage Barometer Research, 30% of all adults in the united state requirement life insurance policy and don't have any type of plan yet. Degree term life is foreseeable and budget friendly, that makes it among the most popular types of life insurance policy.

Table of Contents

Latest Posts

Covering Funeral Costs

What Is Funeral Insurance

Immediate Cover Funeral Plan

More

Latest Posts

Covering Funeral Costs

What Is Funeral Insurance

Immediate Cover Funeral Plan