All Categories

Featured

Table of Contents

Home loan life insurance policy provides near-universal protection with marginal underwriting. There is typically no medical assessment or blood example needed and can be a beneficial insurance plan alternative for any type of house owner with significant pre-existing clinical problems which, would prevent them from getting typical life insurance policy. Other advantages consist of: With a home loan life insurance policy policy in position, successors will not need to stress or wonder what could happen to the household home.

With the home loan repaid, the family will constantly belong to live, given they can manage the residential or commercial property tax obligations and insurance policy each year. mortgage death insurance cost.

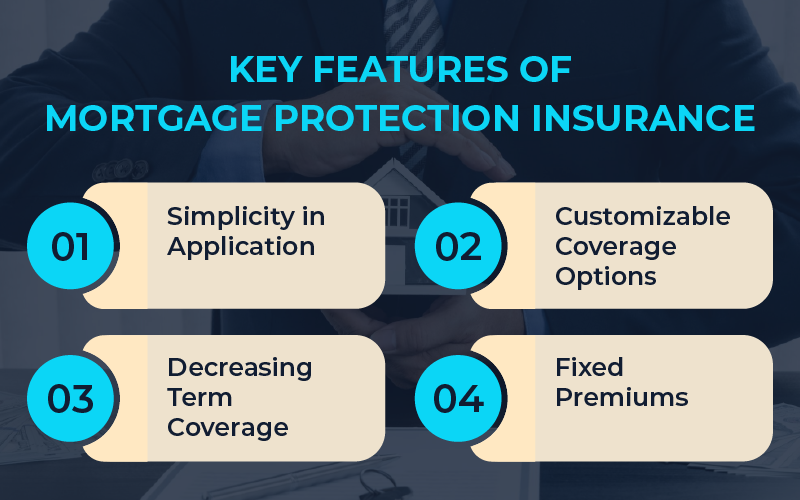

There are a couple of different kinds of mortgage protection insurance, these consist of:: as you pay even more off your home mortgage, the quantity that the policy covers lowers in line with the superior equilibrium of your mortgage. It is the most common and the cheapest kind of mortgage protection - life insurance instead of mortgage insurance.: the amount insured and the costs you pay stays level

This will repay the mortgage and any type of remaining equilibrium will most likely to your estate.: if you desire to, you can add significant disease cover to your home loan protection policy. This means your mortgage will certainly be cleared not just if you pass away, however also if you are identified with a major ailment that is covered by your policy.

Is Mortgage Insurance The Same As Home Insurance

Additionally, if there is an equilibrium staying after the mortgage is removed, this will go to your estate. If you transform your home loan, there are numerous points to think about, depending upon whether you are covering up or expanding your mortgage, switching, or paying the mortgage off early. If you are covering up your home mortgage, you need to ensure that your plan meets the brand-new worth of your home loan.

Contrast the prices and benefits of both alternatives (mortgage insurance and pmi). It may be less costly to keep your initial home mortgage security plan and then acquire a second plan for the top-up amount. Whether you are topping up your mortgage or expanding the term and need to get a brand-new policy, you may locate that your costs is greater than the last time you obtained cover

Loan Insurance Quote

When switching your home mortgage, you can appoint your mortgage defense to the new loan provider. The costs and degree of cover will coincide as before if the amount you obtain, and the regard to your mortgage does not alter. If you have a policy with your loan provider's group scheme, your lender will certainly cancel the plan when you change your mortgage.

There will not be an emergency where a large expense schedules and no other way to pay it so right after the fatality of a loved one. You're giving peace of mind for your family! In The golden state, home loan protection insurance covers the whole exceptional equilibrium of your lending. The survivor benefit is an amount equal to the balance of your home mortgage at the time of your passing away.

Mppi Insurance

It's important to recognize that the survivor benefit is given directly to your creditor, not your liked ones. This ensures that the staying debt is paid in complete and that your enjoyed ones are spared the economic stress. Mortgage defense insurance can additionally provide momentary insurance coverage if you come to be impaired for an extended duration (generally six months to a year).

There are lots of advantages to getting a home loan security insurance coverage in The golden state. A few of the top advantages include: Assured approval: Even if you're in poor wellness or job in a hazardous profession, there is assured approval without any medical examinations or lab examinations. The very same isn't true permanently insurance coverage.

Special needs security: As specified over, some MPI policies make a couple of home loan repayments if you end up being disabled and can not generate the same revenue you were accustomed to. It is important to keep in mind that MPI, PMI, and MIP are all various kinds of insurance coverage. Home mortgage protection insurance (MPI) is designed to pay off a home mortgage in instance of your death.

Homeowners Insurance If Spouse Dies

You can even use online in mins and have your policy in location within the same day. To find out more about getting MPI protection for your home mortgage, get in touch with Pronto Insurance coverage today! Our experienced representatives are below to address any questions you might have and supply more help.

It is suggested to compare quotes from various insurance firms to discover the most effective price and insurance coverage for your needs. MPI uses numerous benefits, such as comfort and simplified certification processes. It has some limitations. The survivor benefit is straight paid to the loan provider, which limits flexibility. In addition, the benefit amount decreases with time, and MPI can be a lot more pricey than common term life insurance policy plans.

Does Private Mortgage Insurance Cover Death

Enter fundamental info concerning yourself and your home mortgage, and we'll compare prices from different insurance providers. We'll additionally show you just how much insurance coverage you need to shield your mortgage. Get started today and offer on your own and your household the tranquility of mind that comes with knowing you're safeguarded. At The Annuity Professional, we comprehend home owners' core trouble: ensuring their family members can maintain their home in the event of their death.

The main advantage here is clearness and confidence in your decision, recognizing you have a plan that fits your needs. As soon as you accept the strategy, we'll take care of all the documentation and setup, guaranteeing a smooth execution process. The positive outcome is the peace of mind that features recognizing your family is shielded and your home is safe and secure, regardless of what takes place.

Specialist Recommendations: Advice from skilled professionals in insurance coverage and annuities. Hassle-Free Setup: We manage all the documentation and execution. Cost-efficient Solutions: Locating the best coverage at the lowest feasible cost.: MPI specifically covers your mortgage, offering an added layer of protection.: We function to locate the most affordable remedies tailored to your budget plan.

They can give information on the protection and advantages that you have. On standard, a healthy and balanced person can expect to pay around $50 to $100 monthly for mortgage life insurance. However, it's suggested to get a customized home loan life insurance policy quote to get an exact price quote based on specific scenarios.

Table of Contents

Latest Posts

Covering Funeral Costs

What Is Funeral Insurance

Immediate Cover Funeral Plan

More

Latest Posts

Covering Funeral Costs

What Is Funeral Insurance

Immediate Cover Funeral Plan